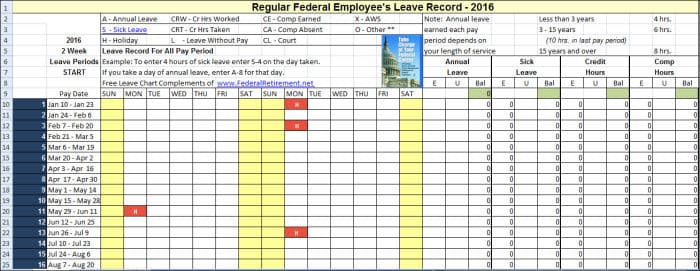

A payroll template Excel is a pre-formatted Excel spreadsheet designed specifically for managing payroll tasks. It provides a structured layout for recording employee information, calculating earnings, deductions, and taxes, and generating paychecks.

Using a payroll template Excel offers numerous benefits. It streamlines the payroll process, reduces errors, saves time, and ensures compliance with tax regulations. Payroll templates are also customizable, allowing businesses to tailor them to their specific needs.

In this article, we will delve into the key features and benefits of using a payroll template Excel. We will also provide step-by-step instructions on how to create and use a payroll template in Excel.

Payroll Template Excel

A payroll template Excel is an essential tool for businesses of all sizes. It provides a structured and efficient way to manage payroll tasks, ensuring accuracy and compliance.

- Customization: Payroll templates can be tailored to meet the specific needs of any business.

- Automation: Templates automate complex calculations, saving time and reducing errors.

- Compliance: Templates help businesses stay compliant with tax regulations.

- Security: Templates protect sensitive employee data.

- Integration: Templates can be integrated with other software systems, such as accounting software.

- Accessibility: Templates are easy to use and accessible from any device.

- Affordability: Templates are typically free or low-cost.

- Support: Many providers offer support and resources to help businesses use templates effectively.

Overall, payroll templates Excel offer a comprehensive solution for managing payroll tasks. They are customizable, automated, compliant, secure, integrated, accessible, affordable, and supported. By using a payroll template Excel, businesses can streamline their payroll processes, save time and money, and ensure accuracy and compliance.

Customization

Payroll templates Excel offer unparalleled customization options, allowing businesses to tailor them to their specific requirements. This flexibility is crucial because every business has unique payroll processes, and a one-size-fits-all approach simply won't suffice.

-

Facet 1: Customizing Calculations

Payroll templates Excel empower businesses to customize the calculations used to determine employee pay. This includes the ability to set up different pay rates for different employees, factor in overtime and bonuses, and apply various tax rates and deductions.

-

Facet 2: Adding and Removing Fields

Businesses can add or remove fields from the template to capture the specific employee information they need. For example, a company with a complex benefits package might add fields to track employee contributions to health insurance, retirement plans, and other benefits.

-

Facet 3: Creating Custom Reports

Payroll templates Excel allow businesses to create custom reports that meet their specific reporting needs. These reports can be used to track payroll expenses, analyze employee compensation, and comply with tax regulations.

-

Facet 4: Integrating with Other Systems

Payroll templates Excel can be integrated with other business systems, such as accounting software and HR systems. This integration streamlines payroll processing and reduces the risk of errors.

The customization capabilities of payroll templates Excel make them a valuable tool for businesses of all sizes. By tailoring the template to their specific needs, businesses can streamline their payroll processes, save time and money, and improve accuracy and compliance.

Automation

In the context of payroll processing, automation plays a vital role in streamlining tasks and minimizing errors. Payroll templates Excel leverage automation to perform complex calculations with precision and efficiency.

-

Facet 1: Automating Earnings Calculations

Payroll templates Excel automate the calculation of regular earnings, overtime pay, bonuses, and other forms of compensation. This eliminates the risk of manual errors and ensures accurate calculations, regardless of the complexity of the pay structure.

-

Facet 2: Automating Deductions Calculations

Payroll templates Excel also automate the calculation of deductions, such as taxes, insurance premiums, and retirement contributions. The template can be configured to apply the correct tax rates and deduction amounts based on employee information and withholding allowances.

-

Facet 3: Automating Net Pay Calculations

Once earnings and deductions have been calculated, the payroll template Excel automatically calculates the net pay, which is the amount of pay that the employee receives after all deductions have been taken out.

-

Facet 4: Automating Paycheck Generation

Payroll templates Excel can be used to generate paychecks, which can be printed or distributed electronically. The template can be customized to include the employee's name, address, pay date, earnings, deductions, net pay, and other relevant information.

Overall, the automation capabilities of payroll templates Excel significantly reduce the time and effort required to process payroll. By automating complex calculations, businesses can improve accuracy, streamline their payroll processes, and free up valuable time for other tasks.

Compliance

Payroll compliance is paramount for businesses to avoid legal penalties, reputational damage, and financial losses. Payroll templates Excel play a crucial role in ensuring compliance with complex tax regulations.

Payroll templates Excel are pre-programmed with tax formulas and withholding calculations based on the latest tax laws. This eliminates the risk of manual errors and ensures that businesses accurately calculate and withhold taxes from employee paychecks.

Moreover, payroll templates Excel can generate reports that summarize payroll data and tax payments. These reports can be used to verify compliance with tax regulations and to prepare tax filings.

By using payroll templates Excel, businesses can streamline their payroll processes, improve accuracy, and stay compliant with tax regulations. This provides peace of mind and protects businesses from potential legal and financial risks.

Security

In today's digital age, protecting sensitive employee data is of paramount importance. Payroll templates Excel play a vital role in safeguarding this data, ensuring that it is handled securely and confidentially.

Payroll templates Excel are designed with robust security features to prevent unauthorized access and data breaches. These features include password protection, encryption, and audit trails. By implementing these security measures, businesses can minimize the risk of data theft, fraud, and identity theft.

Moreover, payroll templates Excel help businesses comply with data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations require businesses to implement appropriate security measures to protect personal data, and payroll templates Excel provide a convenient and effective way to meet these requirements.

By utilizing payroll templates Excel, businesses can safeguard sensitive employee data, maintain compliance with data protection regulations, and protect their reputation and financial interests.

Integration

Integration is a crucial aspect of payroll template Excel, as it enables businesses to connect their payroll system with other software systems, such as accounting software. This integration streamlines workflows, eliminates manual data entry, and improves overall efficiency.

-

Facet 1: Streamlined Data Entry

Integration eliminates the need for manual data entry between payroll and accounting systems. Once the payroll template Excel is integrated, employee payroll data, such as earnings, deductions, and taxes, can be automatically transferred to the accounting system. This eliminates the risk of errors and saves significant time.

-

Facet 2: Automated Reconciliation

Integration enables automatic reconciliation between payroll and accounting systems. The payroll template Excel can be configured to generate reports that summarize payroll transactions, which can then be easily reconciled with the accounting system's records. This streamlines the reconciliation process and reduces the risk of errors.

-

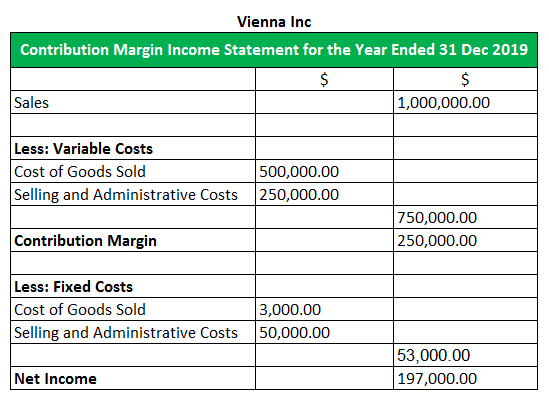

Facet 3: Improved Financial Reporting

Integration provides a comprehensive view of financial data by combining payroll information with accounting data. This enables businesses to generate more accurate and informative financial reports, such as income statements and balance sheets. Improved financial reporting supports better decision-making and financial planning.

-

Facet 4: Enhanced Compliance

Integration can enhance compliance by ensuring that payroll data is consistently and accurately recorded in both the payroll and accounting systems. This reduces the risk of errors or omissions that could lead to compliance issues.

By integrating payroll template Excel with other software systems, businesses can streamline their workflows, improve data accuracy, enhance financial reporting, and strengthen compliance. Integration is a key feature of payroll template Excel that contributes to its overall value and effectiveness.

Accessibility

Accessibility is a crucial aspect of payroll template Excel, as it enables businesses to manage payroll tasks efficiently and effectively, regardless of their location or device.

-

Title of Facet 1: User-friendly Interface

Payroll template Excel is designed with a user-friendly interface that makes it easy for users to navigate and manage payroll tasks. The intuitive layout and clear instructions guide users through the process, regardless of their technical expertise.

-

Title of Facet 2: Cloud-based Access

Payroll template Excel is typically cloud-based, allowing users to access their payroll data and perform payroll tasks from any device with an internet connection. This flexibility enables remote work, facilitates collaboration, and provides real-time access to payroll information.

-

Title of Facet 3: Mobile Compatibility

Many payroll template Excel are mobile-compatible, allowing users to manage payroll tasks on their smartphones or tablets. This mobility provides convenience and enables users to stay on top of payroll tasks even when they are away from the office.

-

Title of Facet 4: Compatibility with Different Operating Systems

Payroll template Excel is compatible with different operating systems, such as Windows, Mac, and Linux. This compatibility ensures that businesses can use the template regardless of their hardware or software preferences.

The accessibility of payroll template Excel empowers businesses to streamline their payroll processes, improve efficiency, and enhance collaboration. By providing easy access to payroll data and enabling remote work, payroll template Excel supports the evolving needs of modern businesses and their employees.

Affordability

Affordability is a significant advantage of payroll template Excel, enabling businesses of all sizes to access powerful payroll management tools without incurring substantial expenses.

-

Facet 1: Free and Open-Source Templates

Numerous free and open-source payroll template Excel are available online, providing businesses with a cost-effective option for payroll management. These templates offer a range of features and can be customized to meet specific requirements.

-

Facet 2: Low-Cost Premium Templates

For businesses seeking more advanced features or support, premium payroll template Excel are available at affordable prices. These templates typically offer additional functionality, such as integration with accounting software, automated calculations, and tax compliance updates.

-

Facet 3: Return on Investment

The affordability of payroll template Excel makes them a cost-effective investment for businesses. By streamlining payroll processes and improving accuracy, businesses can save time and reduce the risk of errors, leading to increased efficiency and cost savings in the long run.

-

Facet 4: Accessibility for Small Businesses

Affordability is particularly beneficial for small businesses with limited resources. Payroll template Excel provides them with access to professional payroll management tools that would otherwise be cost-prohibitive, enabling them to compete effectively in the market.

The affordability of payroll template Excel makes them an accessible and cost-effective solution for businesses of all sizes. By leveraging these templates, businesses can streamline their payroll processes, improve accuracy, and enhance compliance, contributing to overall efficiency and financial success.

Support

In the context of "payroll template excel", support plays a crucial role in ensuring that businesses can effectively utilize these templates to manage their payroll processes. Many providers offer a range of support and resources to assist businesses in various aspects of payroll template usage.

-

Title of Facet 1: Documentation and Tutorials

Providers often provide comprehensive documentation and tutorials that guide businesses through the setup, configuration, and use of payroll templates Excel. These resources help users understand the template's features, functions, and best practices for implementation.

-

Title of Facet 2: Online Help and Support Forums

Many providers offer online help forums where users can connect with other users, ask questions, and share knowledge. These forums serve as valuable platforms for troubleshooting, sharing tips, and staying up-to-date on the latest template updates and features.

-

Title of Facet 3: Email and Phone Support

Providers typically offer email and phone support for users who require personalized assistance. This allows businesses to directly communicate with support representatives to resolve complex issues or receive guidance on specific payroll-related queries.

-

Title of Facet 4: Training and Workshops

Some providers conduct training sessions or workshops to provide in-depth training on payroll templates Excel. These sessions cover advanced features, customization options, and best practices for payroll management using the templates. Businesses can leverage these training opportunities to enhance their payroll processing skills and optimize template usage.

The availability of support and resources from providers empowers businesses to confidently adopt and effectively utilize payroll templates Excel. By providing documentation, online forums, direct support channels, and training opportunities, providers ensure that businesses can maximize the benefits of these templates and streamline their payroll processes.

Frequently Asked Questions about Payroll Templates Excel

Payroll templates Excel are widely used for managing payroll tasks, but they can also raise questions or concerns. This section addresses some common FAQs to provide clarity and guidance.

Question 1: Are payroll templates Excel suitable for businesses of all sizes?Yes, payroll templates Excel are designed to accommodate businesses of all sizes. Whether you have a small team or a large workforce, you can find templates that align with your payroll processing needs.

Question 2: Are payroll templates Excel secure?

Many payroll templates Excel incorporate robust security features to protect sensitive employee data. They often include password protection, encryption, and audit trails to prevent unauthorized access and ensure data confidentiality.

Question 3: Can I customize payroll templates Excel to meet my specific requirements?

Yes, customization is a key advantage of payroll templates Excel. You can modify formulas, add or remove fields, and adjust the layout to align with your unique payroll processes and preferences.

Question 4: Are payroll templates Excel compatible with other software?

Many payroll templates Excel offer seamless integration with other software, such as accounting and HR systems. This integration streamlines data transfer, eliminates manual entry, and enhances overall efficiency.

Question 5: Are payroll templates Excel regularly updated?

Reputable providers of payroll templates Excel typically offer regular updates to ensure compliance with changing tax regulations and industry best practices. These updates are crucial for maintaining accuracy and avoiding legal complications.

Question 6: Can I get support if I encounter issues while using a payroll template Excel?

Many providers offer comprehensive support resources, including documentation, online forums, email and phone support, and training sessions. This support ensures that you can resolve queries, troubleshoot errors, and optimize your use of the template.

By addressing these common questions, we aim to provide a clear understanding of the benefits, capabilities, and support available with payroll templates Excel. These templates empower businesses to streamline their payroll processes, improve accuracy, and ensure compliance with confidence.

Proceed to the next section to explore advanced features and best practices for using payroll templates Excel effectively.

Tips for Using Payroll Templates Excel

Payroll templates Excel offer a powerful tool to streamline payroll processes, but optimizing their use requires careful attention to detail. Here are five essential tips to help you leverage these templates effectively:

Tip 1: Choose the Right Template

Selecting the most suitable payroll template Excel is crucial. Consider the size of your organization, the number of employees, and the complexity of your payroll structure. Opt for a template that aligns with your specific requirements to avoid unnecessary customization or limitations.

Tip 2: Customize Wisely

While customization is a key advantage of payroll templates Excel, it should be done judiciously. Only modify fields and formulas that are essential to your business needs. Excessive customization can introduce errors and make it difficult to maintain the template in the future.

Tip 3: Ensure Accuracy

Accuracy is paramount in payroll processing. Double-check all data entries, formulas, and calculations thoroughly. Consider using formulas to automate calculations and minimize the risk of manual errors. Regularly review your payroll reports to identify any discrepancies or anomalies.

Tip 4: Integrate with Other Systems

Integrating your payroll template Excel with other software systems, such as accounting and HR platforms, can significantly streamline your workflows. Automated data transfer eliminates manual entry, reduces errors, and provides a comprehensive view of employee information.

Tip 5: Seek Professional Support

If you encounter challenges or have specific payroll requirements, don't hesitate to seek professional support. Many providers offer training, consulting, and technical assistance to help you optimize the use of payroll templates Excel. Their expertise can save you time, ensure compliance, and maximize the benefits of these templates.

By following these tips, you can effectively leverage payroll templates Excel to streamline your payroll processes, improve accuracy, and enhance efficiency. Remember, the goal is to simplify and optimize your payroll management, allowing you to focus on other critical aspects of your business.

Conclusion

In this comprehensive exploration of payroll template Excel, we have delved into their importance, benefits, and key features. These templates have revolutionized payroll processing, offering numerous advantages for businesses of all sizes.

Payroll templates Excel provide a structured and efficient way to manage payroll tasks, ensuring accuracy, compliance, and time savings. Their customization capabilities, automation features, and integration options empower businesses to tailor the templates to their specific needs and streamline their payroll processes.

By leveraging payroll templates Excel, businesses can improve the accuracy of their payroll calculations, reduce the risk of errors, and stay compliant with tax regulations. The security features of these templates protect sensitive employee data, while their accessibility and affordability make them a viable option for businesses of all sizes.

Remember, effectively utilizing payroll templates Excel requires careful attention to detail. Choose the right template, customize wisely, ensure accuracy, integrate with other systems, and seek professional support when needed. By following these tips, businesses can harness the full potential of payroll templates Excel and transform their payroll management practices.