A balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It shows the company's assets, liabilities, and equity. Assets are the resources owned by the company, such as cash, inventory, and buildings. Liabilities are the debts owed by the company, such as accounts payable and loans. Equity is the residual value of the company's assets after its liabilities have been subtracted. The balance sheet is used by investors and creditors to assess the financial health of a company and to make informed investment decisions. It is also used by companies to track their financial performance and to make strategic decisions.

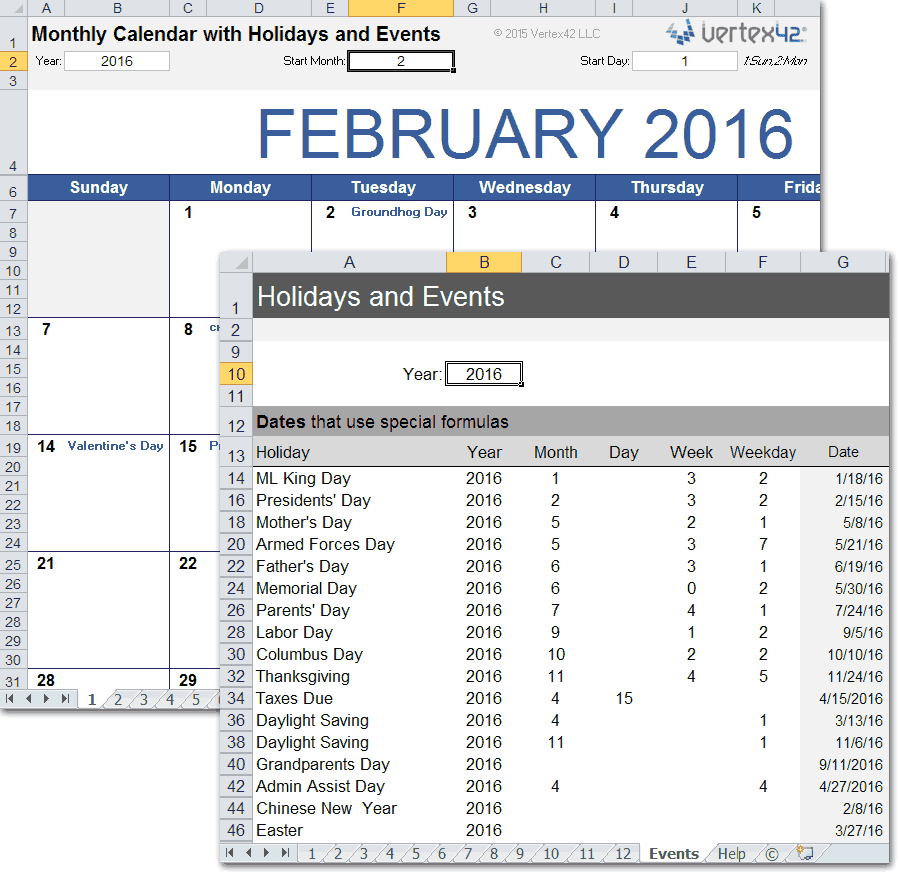

Balance sheets can be created using a variety of software programs, including Microsoft Excel. Excel is a popular choice for creating balance sheets because it is easy to use and provides a variety of features that can help you to create a professional-looking balance sheet. Excel also allows you to easily update your balance sheet as your company's financial situation changes.

If you are new to using Excel, there are a number of resources available to help you get started. You can find tutorials on the Microsoft website and on YouTube. You can also find templates for balance sheets on the Microsoft website and on other websites.

balance sheet excel

A balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It shows the company's assets, liabilities, and equity. Assets are the resources owned by the company, such as cash, inventory, and buildings. Liabilities are the debts owed by the company, such as accounts payable and loans. Equity is the residual value of the company's assets after its liabilities have been subtracted. The balance sheet is used by investors and creditors to assess the financial health of a company and to make informed investment decisions. It is also used by companies to track their financial performance and to make strategic decisions.

- Assets

- Liabilities

- Equity

- Financial health

- Investment decisions

- Financial performance

- Strategic decisions

- Microsoft Excel

These eight key aspects are essential for understanding the role of balance sheet excel in financial reporting and analysis. By understanding these aspects, you can better use balance sheet excel to make informed decisions about your business.

Assets

Assets are the resources owned by a company, such as cash, inventory, and buildings. They are listed on the left-hand side of the balance sheet. Assets are important because they represent the resources that a company has available to generate revenue and profits. Without assets, a company would not be able to operate.

Balance sheet excel is a spreadsheet template that can be used to create a balance sheet. It is a valuable tool for businesses of all sizes because it can help them to track their assets and liabilities and to make informed financial decisions. Balance sheet excel can also be used to create financial projections and to compare a company's financial performance to that of its competitors.

The connection between assets and balance sheet excel is important because it allows businesses to track their financial performance and to make informed financial decisions. By understanding the relationship between assets and balance sheet excel, businesses can improve their financial health and achieve their long-term goals.

Liabilities

Liabilities are the debts owed by a company, such as accounts payable and loans. They are listed on the right-hand side of the balance sheet. Liabilities are important because they represent the claims of creditors against a company's assets. If a company is unable to pay its liabilities, it may be forced to file for bankruptcy.

Balance sheet excel is a spreadsheet template that can be used to create a balance sheet. It is a valuable tool for businesses of all sizes because it can help them to track their assets and liabilities and to make informed financial decisions. Balance sheet excel can also be used to create financial projections and to compare a company's financial performance to that of its competitors.

The connection between liabilities and balance sheet excel is important because it allows businesses to track their financial performance and to make informed financial decisions. By understanding the relationship between liabilities and balance sheet excel, businesses can improve their financial health and achieve their long-term goals.

Equity

Equity is the residual value of a company's assets after its liabilities have been subtracted. It represents the ownership interest of the company's shareholders.

-

Share capital

Share capital is the amount of money that a company has raised from issuing shares. It is a permanent source of funding for the company.

-

Retained earnings

Retained earnings are the profits that a company has accumulated over time. They are a source of funding for the company's operations and can be used to pay dividends to shareholders.

-

Other equity

Other equity includes items such as share premiums and treasury shares. These items can have a positive or negative impact on a company's equity.

Balance sheet excel is a spreadsheet template that can be used to create a balance sheet. It is a valuable tool for businesses of all sizes because it can help them to track their assets, liabilities, and equity. Balance sheet excel can also be used to create financial projections and to compare a company's financial performance to that of its competitors.

The connection between equity and balance sheet excel is important because it allows businesses to track their financial performance and to make informed financial decisions. By understanding the relationship between equity and balance sheet excel, businesses can improve their financial health and achieve their long-term goals.

Financial health

Financial health is a measure of a company's ability to meet its financial obligations and to generate profits. It is important because it can affect a company's ability to attract investors, obtain financing, and grow its business. There are many factors that can affect a company's financial health, including its profitability, liquidity, and solvency.

Balance sheet excel is a spreadsheet template that can be used to create a balance sheet. A balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It shows the company's assets, liabilities, and equity. By analyzing a balance sheet, investors and creditors can assess a company's financial health and make informed investment decisions.

The connection between financial health and balance sheet excel is important because it allows businesses to track their financial performance and to make informed financial decisions. By understanding the relationship between financial health and balance sheet excel, businesses can improve their financial health and achieve their long-term goals.

For example, a company that is experiencing financial difficulties may use balance sheet excel to identify areas where it can cut costs or increase revenue. By taking these steps, the company can improve its financial health and avoid bankruptcy.

Balance sheet excel is a valuable tool for businesses of all sizes. It can help businesses to track their financial performance, to make informed financial decisions, and to improve their financial health.

Investment decisions

Investment decisions are an important part of financial planning. When making investment decisions, investors consider a variety of factors, including the risk and return of the investment, the investor's financial goals, and the investor's time horizon. Balance sheet excel can be a valuable tool for investors when making investment decisions.

Balance sheet excel can be used to assess a company's financial health. By analyzing a company's balance sheet, investors can get a better understanding of the company's assets, liabilities, and equity. This information can help investors to make informed investment decisions.

For example, an investor who is considering investing in a company may use balance sheet excel to assess the company's financial health. The investor may look at the company's assets to see if the company has enough resources to generate revenue and profits. The investor may also look at the company's liabilities to see if the company has too much debt. By analyzing the company's balance sheet, the investor can make a more informed investment decision.

Balance sheet excel is a valuable tool for investors when making investment decisions. By analyzing a company's balance sheet, investors can get a better understanding of the company's financial health and make more informed investment decisions.

Financial performance

Financial performance is a measure of how well a company is doing financially. It is important because it can affect a company's ability to attract investors, obtain financing, and grow its business. There are many factors that can affect a company's financial performance, including its profitability, liquidity, and solvency.

-

Profitability

Profitability is a measure of a company's ability to generate profits. It is calculated by subtracting a company's expenses from its revenue. A company that is profitable is able to generate enough revenue to cover its expenses and make a profit.

-

Liquidity

Liquidity is a measure of a company's ability to meet its short-term financial obligations. It is calculated by dividing a company's current assets by its current liabilities. A company that is liquid has enough cash and other current assets to meet its short-term obligations.

-

Solvency

Solvency is a measure of a company's ability to meet its long-term financial obligations. It is calculated by dividing a company's total assets by its total liabilities. A company that is solvent has enough assets to cover its liabilities.

-

Return on equity (ROE)

ROE is a measure of a company's profitability relative to its equity. It is calculated by dividing a company's net income by its shareholder equity. A company with a high ROE is generating a good return on its shareholders' investment.

Balance sheet excel can be a valuable tool for businesses of all sizes. It can help businesses to track their financial performance, to make informed financial decisions, and to improve their financial health.

Strategic decisions

Strategic decisions are those that have a long-term impact on a company's direction and performance. They are typically made by top management and involve the allocation of resources, the setting of goals, and the development of plans to achieve those goals. Balance sheet excel can be a valuable tool for making strategic decisions because it allows businesses to track their financial performance and to make informed financial decisions.

For example, a company that is considering expanding into a new market may use balance sheet excel to assess the financial implications of this decision. The company may use balance sheet excel to project its revenue and expenses in the new market and to determine whether the expansion is likely to be profitable. By using balance sheet excel, the company can make a more informed decision about whether or not to expand into the new market.

Strategic decisions can have a significant impact on a company's financial performance. By using balance sheet excel to track their financial performance and to make informed financial decisions, businesses can improve their chances of making successful strategic decisions.

Microsoft Excel

Microsoft Excel is a spreadsheet application developed by Microsoft for Windows, macOS, iOS, and Android. It is a widely used tool for creating and managing spreadsheets, which are electronic documents that store data in a tabular format. Spreadsheets are used for a variety of purposes, including financial planning, budgeting, data analysis, and forecasting.

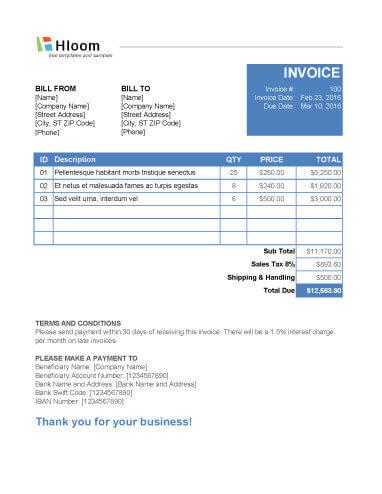

Balance sheet excel is a spreadsheet template that is used to create a balance sheet. A balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It shows the company's assets, liabilities, and equity. Balance sheet excel is a valuable tool for businesses of all sizes because it can help them to track their financial performance and to make informed financial decisions.

The connection between Microsoft Excel and balance sheet excel is important because Microsoft Excel is the most popular spreadsheet application in the world. This means that there are a large number of resources available to help businesses learn how to use balance sheet excel. Additionally, Microsoft Excel is a powerful tool that can be used to create a variety of financial statements, including balance sheets, income statements, and cash flow statements.

By understanding the connection between Microsoft Excel and balance sheet excel, businesses can improve their financial performance and achieve their long-term goals.

Frequently Asked Questions about Balance Sheet Excel

Balance sheet excel is a spreadsheet template that can be used to create a balance sheet. A balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It shows the company's assets, liabilities, and equity.

Question 1: What is balance sheet excel?

Balance sheet excel is a spreadsheet template that is used to create a balance sheet. It is a valuable tool for businesses of all sizes because it can help them to track their financial performance and to make informed financial decisions.

Question 2: Why is balance sheet excel important?

Balance sheet excel is important because it allows businesses to track their financial performance and to make informed financial decisions. By understanding their financial health, businesses can make better decisions about how to allocate their resources and how to grow their business.

Question 3: How can I use balance sheet excel?

Balance sheet excel is easy to use. Simply enter your company's financial data into the template and the spreadsheet will automatically generate a balance sheet. You can then use the balance sheet to track your financial performance and to make informed financial decisions.

Question 4: What are the benefits of using balance sheet excel?

There are many benefits to using balance sheet excel. Some of the benefits include:

- Ease of use

- Accuracy

- Time savings

- Improved financial decision-making

Question 5: Where can I find balance sheet excel templates?

There are many places where you can find balance sheet excel templates. Some popular sources include:

- Microsoft Office website

- Google Sheets

- Vertex42

Question 6: How can I learn more about balance sheet excel?

There are many resources available to help you learn more about balance sheet excel. Some popular resources include:

- Microsoft Office support website

- Google Sheets support website

- Vertex42 support website

Summary of key takeaways or final thought

Balance sheet excel is a valuable tool for businesses of all sizes. It can help businesses to track their financial performance, to make informed financial decisions, and to improve their financial health.

Transition to the next article section

If you are interested in learning more about balance sheet excel, there are many resources available to help you get started.

Balance Sheet Excel Tips

Balance sheet excel is a valuable tool for businesses of all sizes. It can help businesses to track their financial performance, to make informed financial decisions, and to improve their financial health.

Tip 1: Use a template

There are many balance sheet excel templates available online. Using a template can save you time and ensure that your balance sheet is accurate and complete.

Tip 2: Enter your data accurately

It is important to enter your data accurately into your balance sheet excel template. Errors in your data can lead to inaccurate financial statements.

Tip 3: Keep your balance sheet up to date

Your balance sheet should be updated regularly to reflect your company's financial performance. This will help you to track your progress and to make informed financial decisions.

Tip 4: Use your balance sheet to make informed financial decisions

Your balance sheet can be used to make informed financial decisions about your business. For example, you can use your balance sheet to:

- Assess your company's financial health

- Make investment decisions

- Obtain financing

Tip 5: Get help from a professional

If you are not comfortable using balance sheet excel, you can get help from a professional. A professional can help you to create a balance sheet that is accurate and complete.

Summary of key takeaways or benefits

By following these tips, you can use balance sheet excel to track your financial performance, to make informed financial decisions, and to improve your financial health.

Transition to the article's conclusion

Balance sheet excel is a valuable tool for businesses of all sizes. By understanding the basics of balance sheet excel and by following these tips, you can use balance sheet excel to improve your financial performance and to achieve your long-term goals.

Conclusion

Balance sheet excel is a valuable tool for businesses of all sizes. It can help businesses to track their financial performance, to make informed financial decisions, and to improve their financial health. By understanding the basics of balance sheet excel and by following the tips outlined in this article, you can use balance sheet excel to improve your financial performance and to achieve your long-term goals.

In conclusion, balance sheet excel is a powerful tool that can be used to improve your financial performance. By using balance sheet excel, you can make informed financial decisions that will help your business to grow and prosper.